Investing in equity has been a historical driver of attractive returns over the medium to long term. Despite recent fluctuations in the Nifty 50 index over the past 2-3 years, it has delivered a substantial 85% return over a 5-year period. For investors seeking stability within a medium-term horizon, large-cap mutual funds emerge as a rewarding choice. In this comprehensive guide, we delve into the top-performing large-cap mutual funds that have consistently delivered robust returns over the last 5 years, offering insights into their performance through rolling returns analysis.

Selecting the Best Large Cap Mutual Funds:

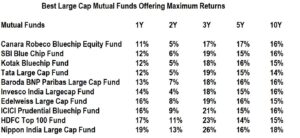

Our selection process prioritizes funds based on the highest returns, regardless of their Assets Under Management (AUM). This straightforward approach can be replicated by anyone using financial websites like Moneycontrol or ValueResearchOnline.

Key Observations from Top-Performing Large-Cap Funds:

Outperformance Against Benchmarks:

Despite the Nifty 100 delivering an annualized return of 12.4% over the last 5 years, the identified 10 large-cap funds have outperformed, yielding returns surpassing 14%.

Even compared to the Nifty 50, which provided an annualized return of 12.9% over the same period, these large-cap funds have demonstrated superior performance.

Medium to Long-Term Consistency:

The majority of these large-cap funds have displayed commendable performance over a medium to long-term horizon, delivering returns ranging from 14% to 16% over the last 5 to 10 years. This underscores the importance of patience in investment strategies.

The Power of Systematic Investment Plan (SIP):

Investors are encouraged to invest consistently through SIP (Systematic Investment Plan) in mutual funds, irrespective of market conditions. This approach capitalizes on the power of compounding and consistent returns, contributing to long-term wealth growth.

Short-Term Volatility:

While some of these funds have excelled in the medium to long term, they may have generated lower returns (around 5%) over the past 2-3 years. It’s crucial to recognize that stock markets exhibit volatility in the short term (1 to 3 years), whereas large-cap funds tend to excel in the medium to long term.

Performance Analysis through Rolling Returns:

3-Year Rolling Perspective:

All 10 large-cap funds, with the exception of HDFC Top 100 Fund, have consistently generated positive returns from a 3-year rolling perspective. HDFC Top 100 Fund experienced negative returns only 3% of the time.

5-Year Rolling Perspective:

From a 5-year rolling perspective, these top-performing funds have demonstrated remarkable consistency, delivering positive returns over 99.2% of the time.

Conclusion:

Rather than solely relying on historical returns, investors are advised to align their mutual fund choices with their financial goals and investment horizon. For those with long-term objectives seeking stable returns, investing in these top-performing large-cap funds may prove advantageous. Emphasize consistency in mutual fund returns, considering the impressive track record of these funds with positive returns over 99% of the time. Adopt a disciplined investment approach by leveraging SIPs and capitalize on market corrections that occur every 3 to 6 months to enhance wealth accumulation.